michigan use tax filing

Depending on the volume of sales taxes you collect and the status of your sales tax account with Michigan you may be required to file sales tax. For complete information regarding the Michigan e-file program review the SUW or.

Executive Order 2020 26 Extends Michigan Tax Deadline Kerr Russell

If 100 worth of books is purchased from an online retailer and no sales tax is collected the buyer would become liable to pay Michigan a total of 100 6 600 in use.

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZTWNJMWHK5CTLEW7DSFILLC34M.jpg)

. In order to register for use tax please follow the application process. Treasury is committed to protecting sensitive taxpayer. Michigan Income Tax Forms.

Individuals and Businesses - Use tax on tangible personal property is similar to sales tax but applies to purchases when. You owe use tax for the following types of purchases unless you already paid at least 6 sales tax. 31 2022 can be e-Filed in conjunction with a IRS Income Tax Return.

Welcome to Michigan Treasury Online MTO. A filing frequency will be assigned upon a taxpayers estimated level of activity. MTO is the Michigan Department of Treasurys web portal to many business taxes.

The second 50 payment. The following situations are the most common cases where you. Sales and Use Tax Filing Deadlines.

Sales and Use Tax Sales Use and Withholding Tax Payment Options Information Withholding Tax Withholding Tax. Internet or mail order purchases from out-of. 075 of the tax which is due at the rate of 4 for the prior month in which there is a maximum due tax of twenty thousand dollars.

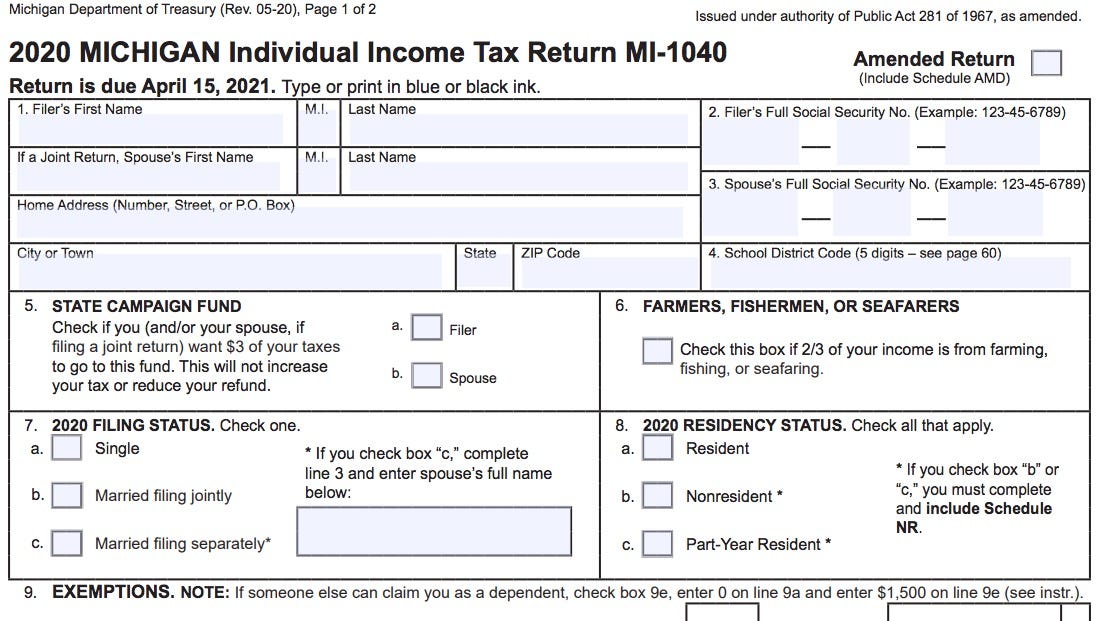

For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040. May be submitted directly to Treasury by being uploaded through the Michigan Treasury Online MTO bulk e-file application or by being transmitted by a Transmitter through a Web Service. MTO is the Michigan Department of Treasurys web portal to many business taxes.

Details on how to only. Treasury is committed to protecting sensitive taxpayer. A vendor can take of the greater of.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Generally companies will want to use Michigan Treasury Online or MTO for short to register file and pay Michigan sales and use taxes. Calendar of Michigan Sales Tax Filing Dates.

The first 50 payment is due on the 20th day of the current month. 4 rows The Michigan Department of Treasury requires all sales tax filing to be completed by the 20th. Use tax is a companion tax to sales tax.

After the first tax year. The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay. View a list of approved companies that offer e-file software for Michigan SUW and CTYW tax returns.

Welcome to Michigan Treasury Online MTO. Log in Forgot password View Available Courts Sign Up. All businesses are required to file an annual return each year.

For businesses it is done on the same form as sales tax and. While the state allows taxpayers to mail. In Michigan that tax is called use tax.

Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under. Michigan State Income Tax Forms for Tax Year 2022 Jan. Sales Use and Withholding taxes are filed on a monthly quarterly or annual basis.

Michigan 2290 Michigan Dmv E File Hvut Form 2290

Tax Forms For Michigan Unemployment Claimants Now Available Online

Michigan Income Tax Filing Deadlines Automatically Extended Varnum Llp

Mi Property Tax Credit E Filing

Extending The Michigan Tax Filing Deadline

Tax Problem Resolution Services In Canton Michigan Tax Avenger

East Lansing Extends Income Tax Filing Deadline To June 1 Wlns 6 News

Michigan State Tax Form Fill Online Printable Fillable Blank Pdffiller

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

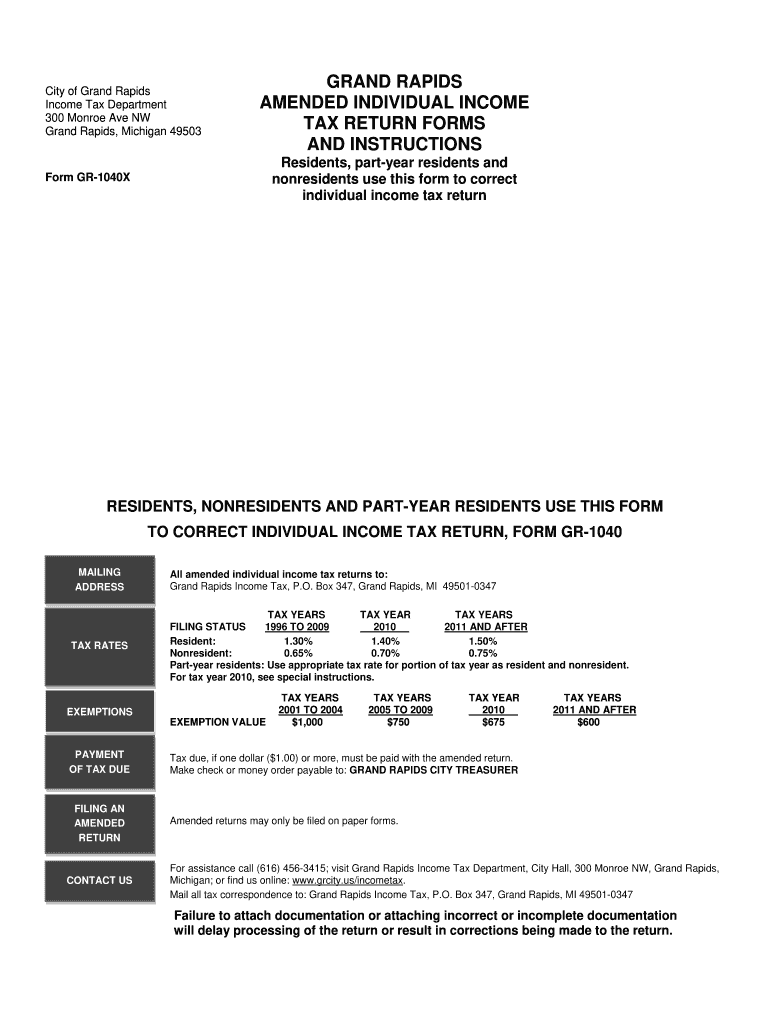

Grand Rapids Tax For Gr 1040x Fill Out Sign Online Dochub

How To File And Pay Sales Tax In Michigan Taxvalet

Michigan Sales Tax Tips Agile Consulting

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Mto Michigan Sales Tax Online Filing System Taxconnex

Solved Does The Federal 8949 Form Need To Be Mailed With The Michigan Tax Return

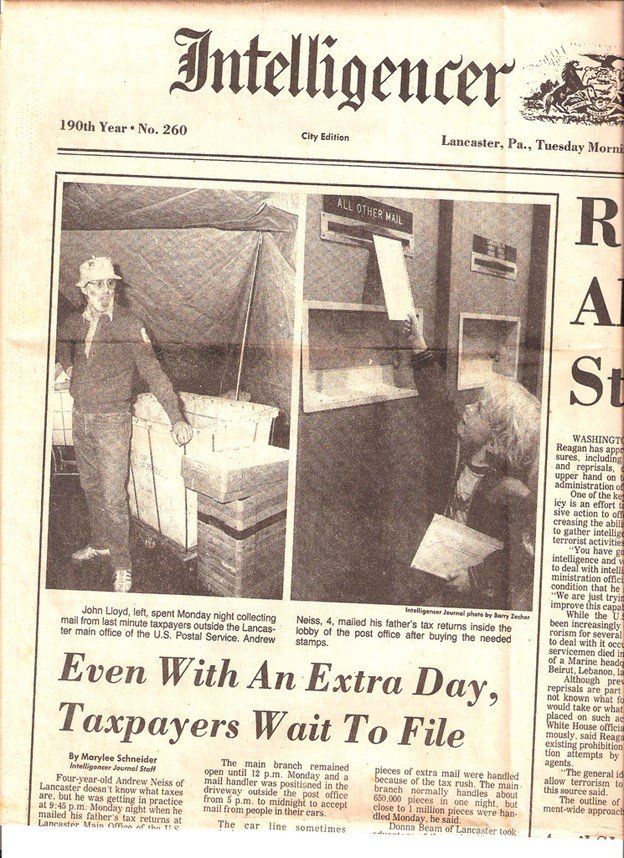

Did You Pay Your Use Tax This Year Michigan Expected To Lose 482 Million From E Commerce Mlive Com

Filing A Michigan State Tax Return Things To Know Credit Karma