rhode island property tax rates 2020

For a more specific estimate find the calculator for your. Directions Google Maps.

Consumer Alert As Home Values Soar Towns Consider Property Tax Relief Wjar

Tax rates are expressed in dollars per 1000 of assessed value.

. Tax Year 2020-2021 FY21 Residential Tax Rate. The median property tax on a 26710000 house is 360585 in Rhode Island. Motor Vehicles and Trailers 2288.

Cassius Shuman - June 5 2020 1205 am. 3470 - apartments with six or more units. 1407 per thousand of the assessed property value.

The project commenced in January 2019. 6 unit apt Commercial Industrial Mixed Use. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business.

2020 Tax Rates. Current Year Tax Rates 2021 All tax rates are expressed as dollars per 1000 of assessed value. If you dispose of your vehicle by any means sale transfer theft collision.

Sewer Use rate is 52799 per. East Providence City Hall 145 Taunton Ave. Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year.

The rhode island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island Division of Taxation. East Providence RI 02914 401 435-7500.

FREQUENTLY ASKED QUESTIONS. 53000 per unit per year. Real Estate Residential 2101.

400000 exemption assessed at 80 of NADA value. 2989 - two to five family. Rhode Island Property Tax Rates.

Cities and towns in Rhode Island set tax rates to pay for things like schools parks and law enforcement. The current tax rates for the 2021 Tax Bills are. Our Search Covers City County State Property Records.

1915thousand dollars of valuation. The school-related tax rate is 1072 per thousand dollars of assessed value and the town-related tax rate is 373 per thousand dollars of assessed value. Re-ranked by 2020 median residential property value.

1407 per thousand of the assessed property value. You can look up your recent appraisal by filling out the form below. The sales tax is a levy imposed on the retail sale rental or lease of many goods and services.

The median property tax on a 26710000 house is 280455 in the United States. The FY 2019-2020 property tax rate is 1445 per thousand dollars of assessed valuation. 135 of home value.

Retail and Wholesale Inventory is exempt from assessment. So for example a rate of 2000 is equal to 20 in tax for every 1000 in assessed value. Rhode island has some of the highest property taxes in the us as the state carries an average effective rate of.

Jamestown Residential median value. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the. Data collectors always carry a letter of identification from the Assessors Office a photo ID badge and have their cars registered with the Police Department.

Rhode Island Property Tax Rates. 2989 - two to five family residences. 3000thousand dollars of valuation.

New Shoreham Residential median value. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. 1800 for every 1000.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. 2 Municipality had a revaluation or statistical update effective 123119. 22 rows The average effective property tax rate in Rhode Island is 153 the 10th-highest in the.

1438 per thousand of the assessed property value. Little Compton Residential median value. You will be billed for the amount of days your vehicle was registered in Rhode Island.

Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Tax amount varies by county.

22 rows The average effective property tax rate in Rhode Island is 153 the 10th-highest in the. 7 Rates rounded to two decimals 8 Denotes homestead exemption available 6 Motor vehicles in Portsmouth Richmond Scituate are assessed at. This estimator is based on median property tax values in all of Rhode Islands counties which can vary widely.

1915thousand dollars of valuation. 1735 per thousand of the assessed value. 41 rows West Warwick taxes real property at four distinct rates.

The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax Calculator. Paying your Tax Bill. 1 Rates support fiscal year 2020 for East Providence.

Subscribe for tax news. 1915thousand dollars of valuation. Due Dates 1st quarter.

The sales tax is imposed upon the retailer. 75 of NADA Value and a 5000 ExemptionAll rates are per 1000 of assessment. The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective property tax rate of 135.

3243 - commercial I and II industrial commind. The reassessment project will establish market value as of December 31st 2019 and will be reflected in the tax bills issued in the summer of 2020. One Capitol Hill Providence RI 02908.

3000 for every 1000. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. The Town Assessor has set the tax rates for the 2019-2020 fiscal year.

The current tax rates and exemptions for real estate motor vehicle and tangible property. The current tax rates for the 2021 Tax Bills are. FY2022 starts July 1 2021 and ends June 30 2022Residential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - 3000Motor vehicle phase out exemption.

Tangible Property Tax bills cover the Prior calendar year.

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

The 7 Most Affordable Places To Live On The East Coast Clever Real Estate East Coast Places Vacation Home

The Best State University Systems Smartasset Higher Education Education States

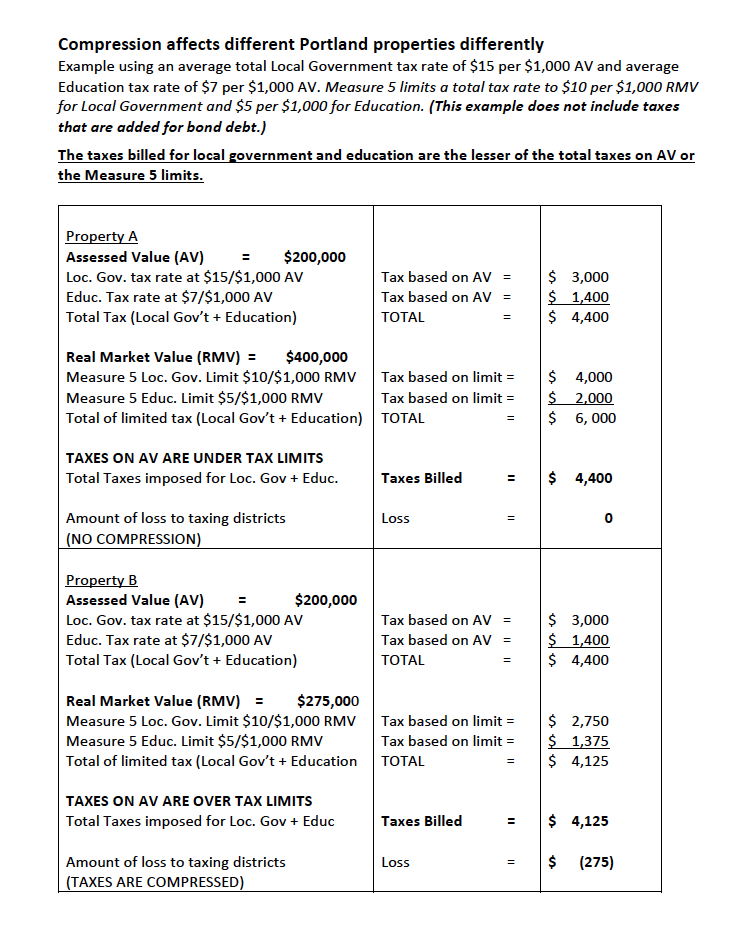

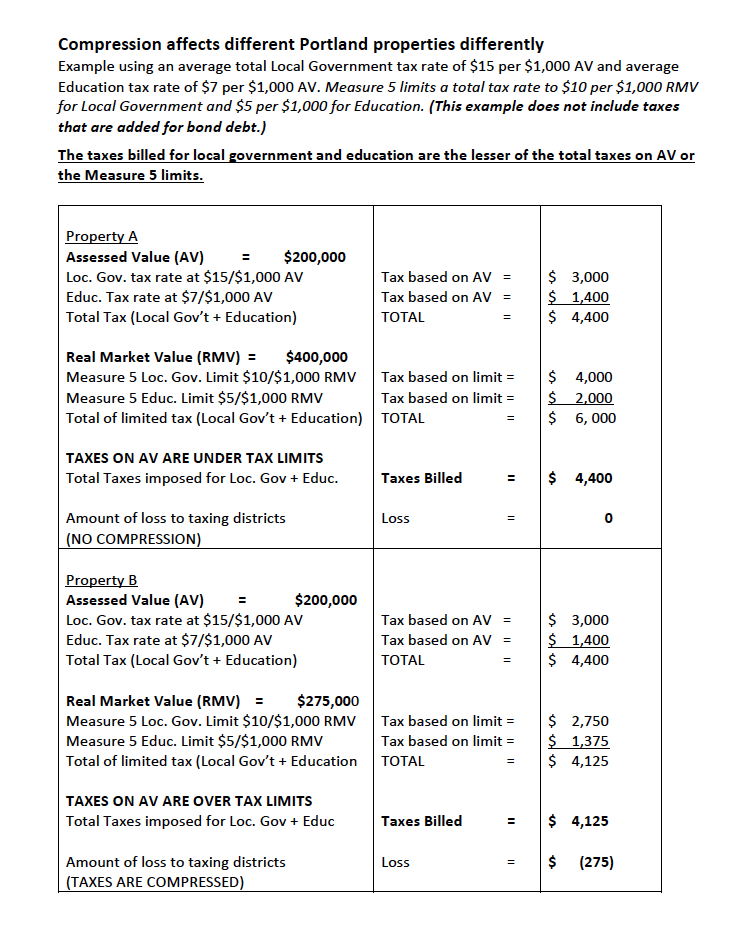

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Property Taxes How Much Are They In Different States Across The Us

Property Tax Five Stone Tax Advisers

Rhode Island Property Tax Calculator Smartasset

Sea Level Rise Viewer Sea Level Rise Sea Level City Photo

Up To Date Photos Maps Schools Neighborhood Info Ranch Style Home Better Homes And Gardens Home Look

Property Tax Comparison By State For Cross State Businesses

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes By State Quicken Loans

Property Taxes By State Propertyshark

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian